Just like everyone else, I love reading stories about the “best stocks” or the “hottest stocks” out there, and I don’t think you can beat the excitement of the ‘Top 10 Stocks for 2013’ articles. I also love when the experts put price targets on certain stocks – as if it’s somehow destined to go to that value. At the same time, it seems like we’re constantly inundated with news on the trendiest, most volatile stocks, which only adds to the excitement.

But are these stories really true? And how well do the stocks in these articles compare to the average?

Unless the person writing the article (or your financial advisor) is a genius & you truly believe it, I think it’s really important to take everything with a grain of salt. *Take special note that EVEN if someone is a genius, it’s still impossible for them to predict what will happen in the future. I, on the other hand, know exactly what is going to happen in the future since I am a genius. And I also created a special time machine to guarantee I won’t make any mistakes. It really works:

Seriously though, it can be really hard to hold off on buying risky stocks, especially when the stock market is in the middle of a rally. It’s like standing in a casino next to a group of slot machines that start paying out large wins to everyone who’s playing. The area gets noisy with excitement. A crowd appears, and people start making even more money, and this continues to happen for a while. You’re suddenly thinking to yourself, “This is crazy!”. An old woman smoking a cigarette cashes out and suddenly walks away. –Since when does that ever happen?!– You’re standing right next to her seat. So, the question is – Do you sit down and play, or do you walk away to play another slot machine in the corner? I think it would be stupid to ignore the excitement (how can this be happening?!), but I also think it would be important to remember that slot machines are designed to make the casino money, and not you. Impulsively, however, I would definitely sit down! With a bigger picture in mind, I would limit the amount of money I put into the slot machine and I’d force myself to make a strong decision on when to stop. This would take a lot of self-discipline though. But, I’m extremely self-conscious of the fact that you can WIN big just as easily as you can LOSE big, and losing big far outweighs the psychological effect of winning big, at least for me. ESPECIALLY in a casino.

Maybe this was a horrible example since the stock market is far from being a casino. But I think you get the point: It’s better to be a part of a rally, at least in a small way, than to just sit on the sidelines blinking mindlessly.

When I first started to research stocks 5 years ago, I came across an article on MSN Money for the Top 10 Valentines Day stocks that year, and they went on to say how their yearly picks continually beat the average. They provided some facts on the fundamentals of the companies, etc. I ended up falling for the advice in the article hook, line, and sinker. On a side note – I always love the disclaimers at the end of those articles stating how the author doesn’t hold any positions in any of the stocks that were mentioned. Ha ha.

Well, at the end of the day, I think it’s important to (1) Not believe in a single source, even if you really think it is trustworthy – IT’S GENIUS!, (2) Not get completely caught up in all of the excitement around you – JACKPOT!!!, and to (3) Realize all of the facts around you – THESE ARE STOCKS, NOT CASINOS. The stock market will definitely pay off if you invest in the right stocks carefully, but…. what the heck are those stocks anyway? Some might argue that it’s better to invest in a low-cost index fund that tracks the Dow, or the S&P 500, since it’s impossible to predict what will go up/down/etc., but I think this type of investment is far better suited for a 401k account, or within an IRA account.

The goal here is to provide a killer stock portfolio while remaining neutral to what the market is currently doing. The stocks below are intended for the longer term, and there is no way they’ll be anywhere as exciting as the trendy technology stocks right now, such as Netflix (NFLX), LinkedIn (LNKD), Apple (AAPL), Facebook (FB), Google (GOOG), Nokia (NOK), or Zynga (ZNGA). The stocks I’ve chosen provide reliable (20+ years) increasing dividends, and none of them have gone significantly up or down throughout their lifetime, either, which is a good thing. I also made some effort to select companies with household names, which means it’s easier to keep track of what they’re doing, and I’ve also made sure to provide enough diversity across multiple industries. Bear in mind that these are slower moving stocks, however, so you won’t get any huge wins in the short-term. These are a lot safer so that you won’t need to worry about huge losses (or gains). 10-15 years from now though, you can look back and smile, just not tomorrow.

**Note: All of the information below has been taken from Google Finance and Yahoo Finance**

(LLY) Eli Lilly & Co., 3.65% Dividend

Eli Lilly and Company discovers, develops, manufactures, and sells products, in one business segment, pharmaceutical products. The Company also has an animal health business segment. It manufactures and distributes its products through facilities in the United States, Puerto Rico, and 15 other countries. Its products are sold in approximately 130 countries. The Company’s products include neuroscience products, endocrinology products, oncology products, cardiovascular products, animal health products and other pharmaceuticals. The Company’s new molecular entities (NMEs), which are in Phase III clinical trial testing include Dulaglutide, Edivoxetine, Ixekizumab, Necitumumab, New insulin glargine product, Novel basal insulin analog, Pomaglumetad Methionil, Ramucirumab, Solanezumab and Tabalumab. In February 2012, the Company acquired ChemGen Corp. On July 7, 2011, it acquired the animal health business of Janssen, a Johnson & Johnson company.

(JNJ) Johnson & Johnson, 3.23% Dividend

Johnson & Johnson is a holding company. The Company, along with its subsidiaries, is engaged in the research and development, manufacture and sale of a range of products in the healthcare field. The Company operates in three segments: Consumer, Pharmaceutical, and Medical Devices and Diagnostics. During the fiscal year ended January 1, 2012 (fiscal 2012), the Company’s subsidiaries operated 139 manufacturing facilities occupying approximately 21.8 million square feet of floor space. Within the United States, eight facilities are used by the Consumer segment, 10 by the Pharmaceutical segment and 34 by the Medical Devices and Diagnostics segment. In June 2012, the Company acquired Synthes, Inc.

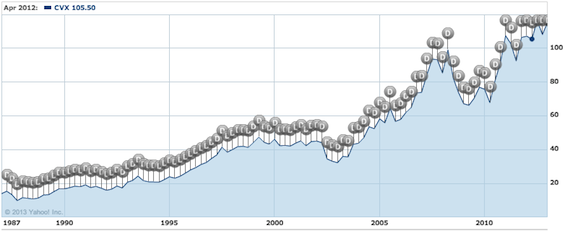

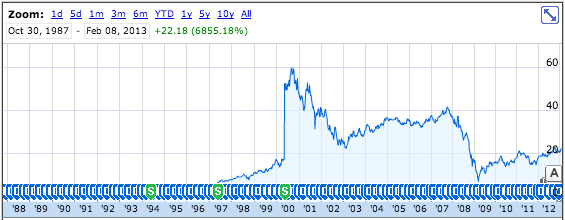

(CVX) Chevron Corporation, 3.11% Dividend

Chevron Corporation (Chevron) manages its investments in subsidiaries and affiliates and provides administrative, financial, management and technology support to the United States and international subsidiaries that engage in petroleum operations, chemicals operations, mining operations, power generation and energy services. Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; processing, liquefaction, transportation and regasification associated with liquefied natural gas; transporting crude oil by international oil export pipelines; transporting, storage and marketing of natural gas; and a gas-to-liquids project. Downstream operations consist primarily of refining crude oil into petroleum products; marketing of crude oil and refined products; transporting crude oil by pipeline, motor equipment and rail car, and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses and fuel and lubricant additives.

(GE) General Electric Company, 3.38% Dividend

General Electric Company (GE) is a diversified technology and financial services company. The products and services of the Company range from aircraft engines, power generation, water processing, and household appliances to medical imaging, business and consumer financing and industrial products. It serves customers in more than 100 countries. Its segments include Energy Infrastructure, Aviation, Healthcare, Transportation, Home & Business Solutions and GE Capital. Effective January 1, 2011, it reorganized the Technology Infrastructure segment into three segments: Aviation, Healthcare and Transportation. In April 2012, GE Healthcare acquired SeqWright, Inc. In May 2012, GE Healthcare, the healthcare business of GE, acquired Xcellerex, Inc., a supplier of manufacturing technologies for the biopharmaceutical industry. In June 2012, GE Healthcare acquired XPRO. In August 2012, it acquired PRESENS. In December 2012, the Company acquired 19% interest in Morpho Detection Inc.

(T) AT&T Inc., 5.10% Dividend

AT&T Inc. (AT&T) is a holding company. AT&T is a provider of telecommunications services in the United States and worldwide. Services offered include wireless communications, local exchange services and long-distance services. AT&T operates in four segments: Wireless, Wireline, Advertising Solutions and Other. Its Wireless subsidiaries provide both wireless voice and data communications services across the United States, and through roaming agreements, in a substantial number of foreign countries. Wireline subsidiaries provide primarily landline voice and data communication services, AT&T U-verse TV, high-speed broadband and voice services (U-verse) and managed networking to business customers. Advertising solutions subsidiaries publish Yellow and White Pages directories and sell directory advertising and Internet-based advertising and local search. AT&T’s Other segment includes customer information services (operator services) and corporate and other operations.

(LMT) Lockheed Martin Corporation, 5.23% Dividend

Lockheed Martin Corporation is a global security and aerospace company principally engaged in the research, design, development, manufacture, integration, and sustainment of technology systems and products. The Company also provides a range of management, engineering, technical, scientific, logistic, and information services. It serves both domestic and international customers with products and services that have defense, civil, and commercial applications, with its principal customers being agencies of the United States Government. It operates in four segments: Aeronautics, Electronic Systems, Information Systems & Global Solutions (IS&GS), and Space Systems. During the year ended December 31, 2011, the Company acquired QTC Holdings Inc. (QTC) and Sim-Industries B.V. In November 2012, the Company acquired Chandler/May, Inc. In December 2012, the Company acquired CDL Systems Ltd.

(KO) The Coca-Cola Company, 2.63% Dividend

The Coca-Cola Company is a beverage company. The Company owns or licenses and markets more than 500 nonalcoholic beverage brands, primarily sparkling beverages but also a variety of still beverages, such as waters, enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, and energy and sports drinks. It owns and markets a range of nonalcoholic sparkling beverage brands, which includes Coca-Cola, Diet Coke, Fanta and Sprite. The Company’s segments include Eurasia and Africa, Europe, Latin America, North America, Pacific, Bottling Investments and Corporate. On December 30, 2011, it acquired Great Plains Coca-Cola Bottling Company in the United States. In December 2011, it acquired an additional minority interest in Coca-Cola Central Japan Company (Central Japan). In September 2012, it acquired approximately 50% equity in Aujan Industries’ beverage business. In January 2013, Sacramento Coca-Cola Bottling Company announced that it had been acquired by the Company.

(VZ) Verizon Communications Inc., 4.64% Dividend

Verizon Communications Inc. (Verizon) is a holding company. The Company is a provider of communications, information and entertainment products and services to consumers, businesses and governmental agencies. It operates in two primary segments: Verizon Wireless and Wireline. Verizon Wireless’ communications products and services include wireless voice and data services and equipment sales, which are provided to consumer, business and government customers across the United States. Wireline’s communications products and services include voice, Internet access, broadband video and data, Internet protocol network services, network access, long distance and other services. In April 2011, Verizon acquired Terremark Worldwide, Inc. (Terremark). In August 2011, it acquired CloudSwitch. In March 2012, Verizon Wireless purchased the operating assets of Cellular One of Northeast Pennsylvania from United States Cellular Corporation. In July 2012, it acquired HUGHES Telematics, Inc.

[…] mutual funds, index funds, etc. I would suggest reliable dividend stocks (see my previous blog post below), but if you want to take a very lazy and safe approach – then you could always invest […]