Mr. Market has a reputation of taking investors on a bumpy ride that instills fear, driving them away from stocks and investing. With all the negative news generated regarding the instability in Europe, the poor job reports, and the chances of looming recessions, it’s no surprise that people avoid the stock market to keep their money in savings accounts and CDs. It makes sense to protect your money this way, but giving in to market-phobia can mean missing out on some big wins while losing out to future inflation.

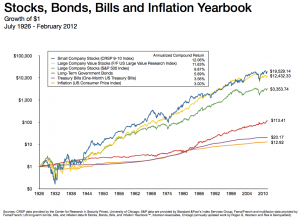

Investing in stocks can be risky, but it doesn’t need to be if you can take the time to invest in safer stocks. A general rule of thumb is that if you can withstand a potential downturn that lasts 5-10 years, then investing in the stock market should be a no-brainer. In most cases, it is even less risky than that! Here, let’s take a look at a common chart on stocks, bonds, bills and inflation.

The chart shows 86 years of history where you can very easily observe an upward trend. There’s no guarantee that past performance will guarantee future returns. But as long as the population continues to grow and we have the natural resources to support the growth, the economy should follow. This will result in future inflation and positive growth in the stock market.

But don’t take the advice from me, take it from the nation’s 400 richest people who have been using Mr. Market to make money from stocks all along.

How the Richest 400 People in America Got So Rich

http://www.theatlantic.com/

After deciding how much money to invest, the next step is to open an account with an online broker. You’ll most likely have a pretty good idea of what you’ll want to invest in by this point; Just make sure you’re not investing everything in 1 or 2 stocks, because I know some really smart friends and family members who sadly fell into this trap. It really changed their opinions of the stock market, too.

There are literally thousands of articles on the internet related to picking safe stock investments, and it’s up to you on how much research you want to do. It really doesn’t take too much work. Just make sure to buy at least 5 stocks in different areas, and to check for consistent dividend payouts. And if you can get vested in a DRIP through a Roth IRA, you’ll be all set.

Sound simple? I thought so. Now get started!

[…] saw a chart on inflation vs. investing. (See below again, or refer to my previous post on the topic here.) The only reason I bring this up is to help others get started with investing on their own, […]

I’m really inspired along with your writing abilities as well as with the layout for your blog. Is that this a paid topic or did you modify it your self? Anyway stay up the nice high quality writing, it’s uncommon to peer a great weblog like this one nowadays.

.

Hi Matt! Thank you for your comments. Finance is one of my passions. My goal is to educate younger people on how to get started with investing in the stock market. I noticed your work at Money Choice. Looks like a great business you have going.